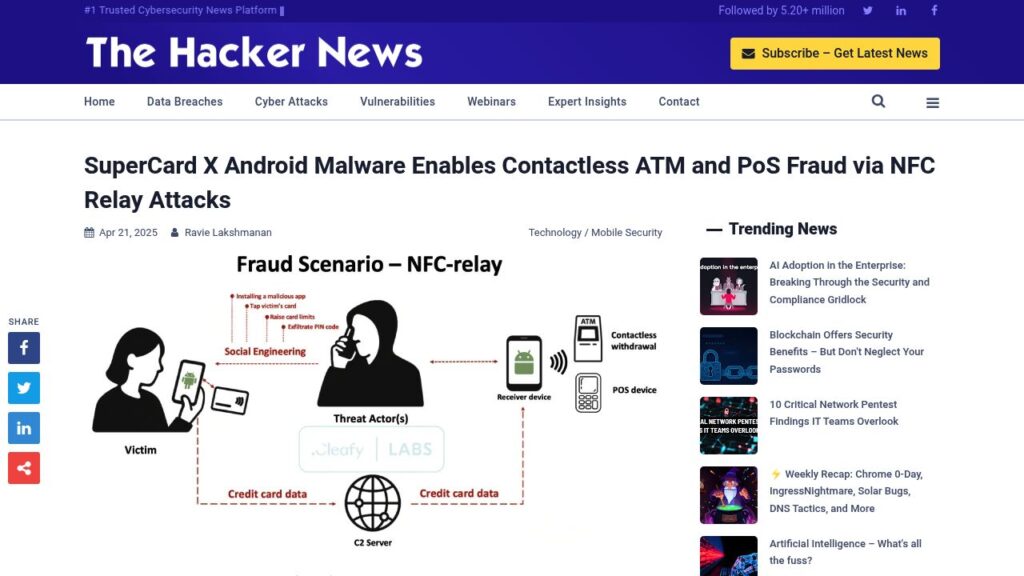

SuperCard X Android Malware Enables Contactless ATM and PoS Fraud Via NFC Relay Attacks

SuperCard X is a new Android malware platform enabling NFC relay attacks, allowing criminals to commit ATM and PoS fraud by intercepting and relaying card details. Targeting Italian banking customers, it employs social engineering tactics through fake apps and deceptive messages that prompt victims to install malicious software. The malware captures card data and relays it to external servers for unauthorized transactions. SuperCard X utilizes sophisticated techniques, including custom app versions and secure communication methods, posing significant financial risks to payment systems. Users are urged to avoid unknown apps and enable protections against malware.

https://thehackernews.com/2025/04/supercard-x-android-malware-enables.html